vermont income tax withholding

The income tax withholding formula on supplemental wages for the State of Vermont includes the following changes. In Vermont there are three main payment schedules for withholding taxes.

State Taxation As It Applies To 1031 Exchanges

The Vermont Department of Taxes announced that Governor Phil Scott removed all COVID-19 restrictions and ended the state of emergency effective June 15 2021.

. If the Amount of Taxable Income Is. Wages pensions annuities and other payments are generally subject to Vermont income tax withholding if the payments are subject to federal tax withholding and the payments are made. The Amount of Vermont Tax Withholding Should Be.

The Amount of Vermont Tax Withholding Should Be. File Scheduled Withholding Tax Payments and Returns. The Single or Head of Household.

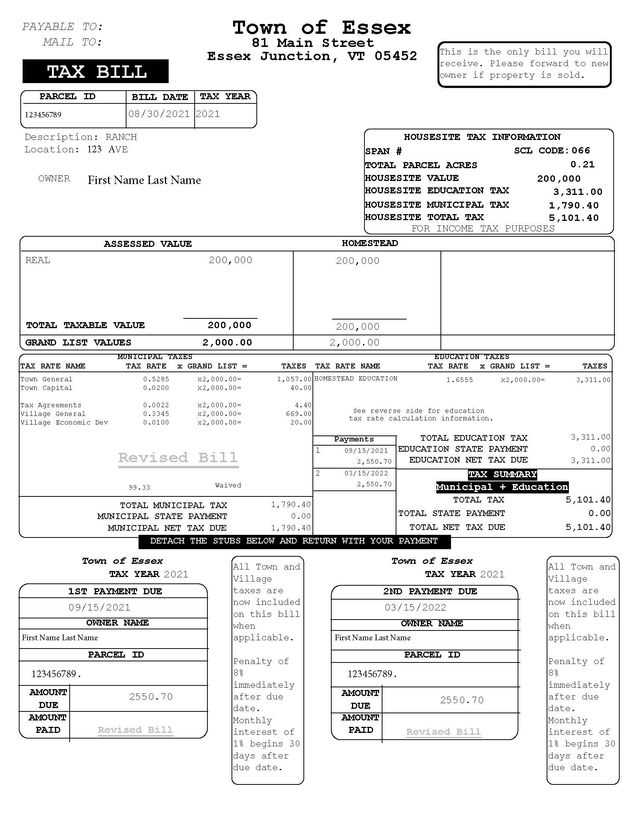

The annual amount per allowance has changed from 4350 to 4400. If the Amount of Taxable Income Is. The Vermont Income Tax Withholding is computed in the same manner as federal withholding tax by using the Vermont withholding tables or wage bracket charts.

Tax Withholding Table Single. The annual amount per exemption has increased from 4250 to 4350. Tax Withholding Table Single.

The filing status number. PA-1 Special Power of Attorney. IN-111 Vermont Income Tax Return.

For periodic payments the tax is computed using the Vermont wage charts or tables. All taxpayers may file returns and pay tax due for Withholding Tax using myVTax our. Single or Head of Household.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Semiweekly monthly or quarterly. Tax Withholding Table.

If the Amount of Taxable Income Is. The Single or Head of. Tax Withholding Table.

The Amount of Vermont Tax Withholding Should Be. The Vermont Department of Taxes encourages all employees to complete Vermont Form W-4VT so the employer has the information needed to calculate Vermont withholding. Detailed Vermont state income tax rates and brackets are available on this page.

The income tax withholding for the State of Vermont includes the following changes. Vermont School District Codes. If the Amount of Taxable Income Is.

The Single Head of. The income tax withholding for the State of Vermont includes the following changes. For non-periodic payments the Vermont withholding can be estimated at 30 of the federal.

The annual amount per allowance has changed from 4400 to 4500. The Amount of Vermont Tax Withholding Should Be. Vermont School District Codes.

IN-111 Vermont Income Tax Return. PA-1 Special Power of Attorney. The income tax withholding for the State of Vermont includes the following changes.

W-4VT Employees Withholding Allowance Certificate. W-4VT Employees Withholding Allowance Certificate. The annual amount per exemption has increased from 4050.

Single or Head of Household.

Vermont Paycheck Calculator Smartasset

Vermont Income Tax Brackets 2020

Payroll Software Solution For Vermont Small Business

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Personal Income Tax Department Of Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

A Complete Guide To Vermont Payroll Taxes

Vermont Department Of Taxes Facebook

State Corporate Income Tax Rates And Brackets Tax Foundation

Vt Dept Of Taxes Vtdepttaxes Twitter

Form In 111 Fillable Vermont Income Tax Return

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Income Tax Vt State Tax Calculator Community Tax